11/03/ · Key Takeaways Margin trading in forex involves placing a good faith deposit in order to open and maintain a position in one or more Margin means trading with leverage, which can increase risk and potential returns. The amount of margin is usually a percentage of the size of the forex positions Forex margin rates are usually expressed as a percentage, with forex margin requirements typically starting at around % in the UK for major foreign exchange currency pairs. Your FX broker’s margin requirement shows you the amount of leverage that you can use when trading forex with that broker 20/07/ · What Is Margin in Forex Trading? Margin is the collateral (or security) that a trader has to deposit with their broker to cover some of the risk that the trader generates for the broker. It is usually a fraction of a trading position and is expressed as a percentage. It is useful to think of

Leverage and Margin in Forex Explained (): Easy Examples ✅

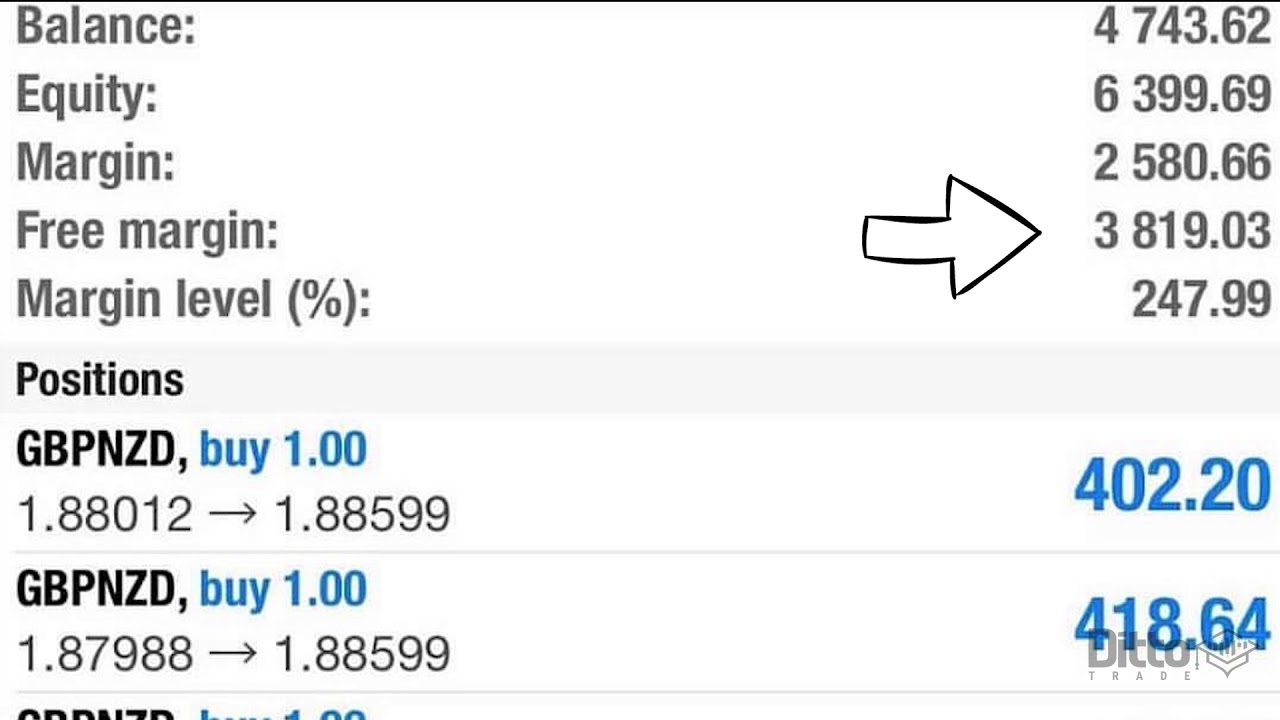

Margin trading in the forex market is the process of making a good faith deposit with a broker in order to open and maintain positions in one or more currencies. Margin is not a cost or a fee, but it is a portion of the customer's account balance that is set margin in forex explained in order trade. The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice.

A margin accountat its core, involves borrowing to increase the size of a position and is usually an attempt to improve returns from investing or trading. For example, investors often use margin accounts when buying stocks. The margin allows them to leverage borrowed money to control a larger position in shares than they'd otherwise be able to control with their own capital alone. Margin accounts are also used by currency margin in forex explained in the forex market.

Margin accounts are offered by brokerage firms to investors and updated as the values of the currencies fluctuate. To get started, traders in the forex markets must first open an account with either a forex broker or an online forex broker. Once an investor opens and funds the accounta margin account is established and trading can begin. An investor must first deposit money into the margin account before a trade can be placed. The amount that needs to be deposited depends on the margin percentage required by the broker.

The amount of margin depends on the policies of the firm. In addition, margin in forex explained, some brokers require higher margin to hold positions over the weekends due to added liquidity risk. When this occurs, the broker will usually instruct the investor to either deposit more money into the account or to close out the position to limit margin in forex explained risk to both parties.

In situations where accounts have lost substantial sums in volatile marketsthe brokerage may liquidate the account and then later inform the customer that their account was subject to a margin call. Investing Essentials. Forex Brokers. Your Money. Personal Finance. Your Practice, margin in forex explained. Popular Courses. Key Takeaways Margin trading in forex involves placing a good faith deposit in order to open and maintain a position in one or more currencies.

Margin means trading with leverage, which can increase risk and potential returns. The amount of margin is usually a percentage of the size of the forex positions and will vary by forex broker.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Articles. Investing Essentials How much can I borrow with a margin account? Forex Brokers 5 Tips For Selecting A Forex Broker, margin in forex explained. Brokers How do initial margin and maintenance margin differ?

Partner Links. Related Terms Maximum Leverage Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account.

Liquidation Level Definition The liquidation level, normally expressed as a percentage, is the point that, if reached, will initiate the automatic closure of existing positions. Cash Trading Definition Cash trading requires that all transactions be paid for by funds available in the account at the time of settlement. Forex Market Definition The forex market is where banks, funds, and individuals can buy or sell currencies for hedging and speculation.

Read how to get started in the forex market. Trading Margin Excess Trading margin excess refers to the funds in a margin account that are available for trading.

Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Margin in forex explained Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

Forex Leverage: 90% Of Beginners Make This Mistake When Trading With Margin...

, time: 15:16Margin in Forex Explained - Should You Avoid This Risky Feature?

Forex margin trading is often used with leverage. It’s the amount of capital you need to have to open a position. Find out how to use margin in Forex effectively 01/12/ · What is Margin in Forex? Margin simply refers to the funds you have provided to your broker for the purpose of safekeeping to cover the risk you create for him. Based on your account strength, the margin is formed by a percentage of the open trading blogger.comted Reading Time: 5 mins 11/03/ · Key Takeaways Margin trading in forex involves placing a good faith deposit in order to open and maintain a position in one or more Margin means trading with leverage, which can increase risk and potential returns. The amount of margin is usually a percentage of the size of the forex positions

Geen opmerkings nie:

Plaas 'n opmerking