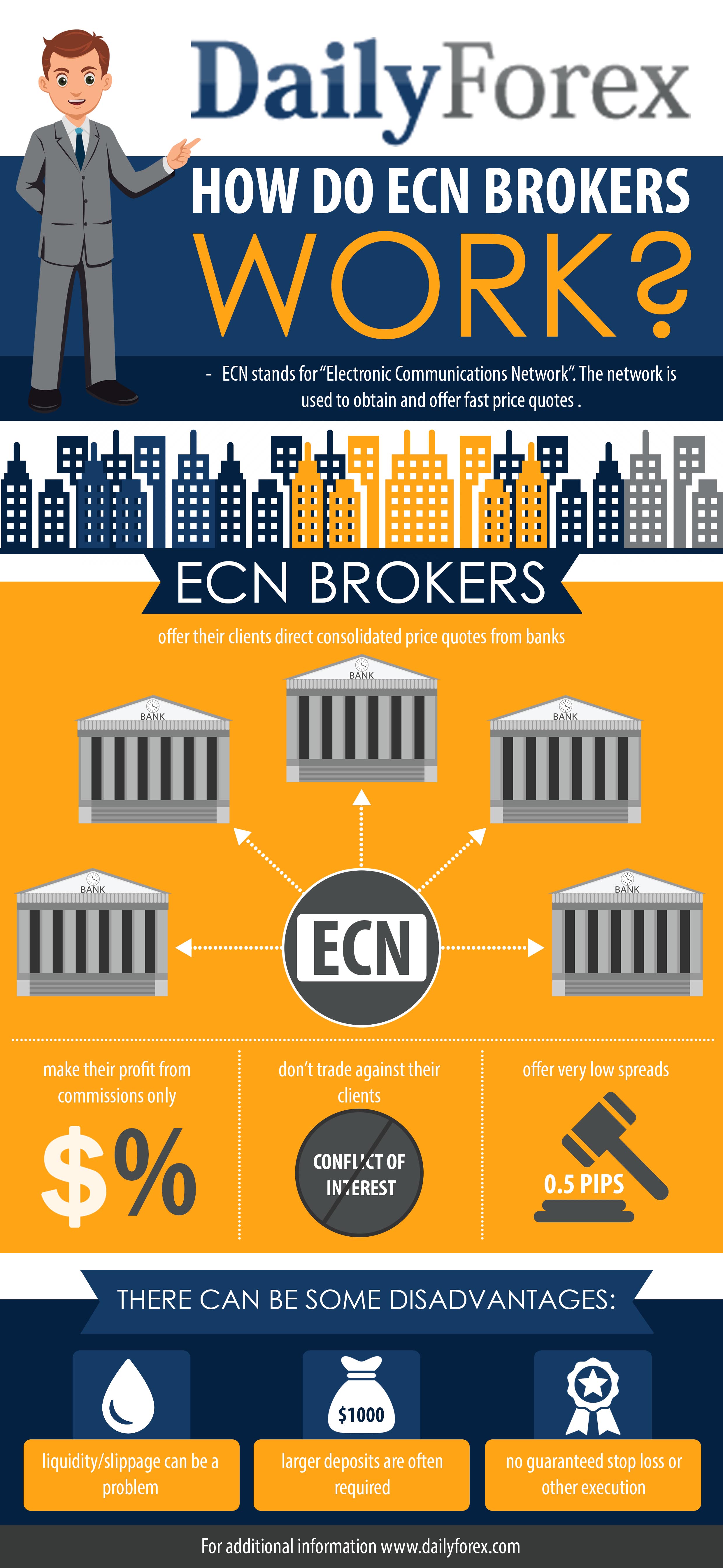

31/01/ · ECN Forex broker vs Market Maker - What is the main difference between the ECN Forex Brokers & Market Maker? Market Maker basically "make" the Forex market. That is, if you are with the trading currency pairs with a market maker, you do not get direct access to the Forex market 30/06/ · Differences between ECN and market maker brokers The primary difference between the two is that ECN supplies direct or 'straight through' access to the interbank market, while a market maker doesn't. At their core, currencies come from the interbank market, a group consisting primarily of large, recognized commercial banks like Citicorp, HSBC, JP Morgan, Deutsche Bank, etc 22/08/ · The market maker broker attracts more money, whereas it is the ECN/STP broker who is the real participant of the Forex market. ECN/STP brokers cannot offer any “negative balance protection”, because it doesn’t make sense to do blogger.comted Reading Time: 7 mins

How to Distinguish Between Market Maker and True ECN/STP Brokers

How can you verify this before you open a live account with a broker? As I mentioned, there are detailed articles on this topic on LuckScout that you can read to learn more. When you open a live account with a market maker broker, indeed you are trading with the broker, not with the real world wide currency market.

The market is the broker itself. Although prices are almost the same as other brokers, on a market maker platform, your orders never go beyond the brokers computers and you trade inside the brokerage firm.

So, if you make profit, the broker has to pay it. Read this article to know how a market maker broker makes money: Market Maker Brokers: Is It Bad or Illegal to Be a Market Maker? They just connect the platform you install on your computer forex market maker broker vs ecn broker the liquidity providers computers.

Read this article to learn about liquidity providers and the way they make money: How Do the Liquidity Providers Make Money and Are They Market Maker? There are so ways to do that: 6 Ways Forex Brokers Cheat You.

Indeed, most of them even help their clients to make profit and grow their accounts, because they will stay with the broker longer and will make bigger positions, and this means more money for the broker too, forex market maker broker vs ecn broker. Some of them even transfer your orders to a so called liquidity provider, but the problem is the liquidity provider is either another market maker brokerage belonged to the same company or a sister company, or, it is a poor bank somewhere in the Pacific ocean.

It is not bad and illegal to be a market maker broker. What is bad or maybe illegal depend on who writes the rules is to try to make the traders lose. They even lose with the demo accounts too. However, the problem comes when market maker brokers get greedy and try to make more money within a shorter time.

Of course, they do their best to stop the winning traders and make them close their account and leave, forex market maker broker vs ecn broker. You are following us on LuckScout to become profitable Forex market maker broker vs ecn broker traders. Many of you have become profitable demo traders already as per the program you are following on LuckScout read this. However, you are worried about the broker you will open your live account with, when you are ready to.

The reason is that past performance is not a guarantee of future results. Even if a broker has been doing good for years, they can change overnight and start cheating their clients, and we will be accused as the referrer too.

So, although it makes a lot of money, we prefer not to enter such a game at all. Traders like to pay less spread to make more profit. So, there is a competition among brokers to offer the lowest possible spread to attract more traders.

Market maker brokers have full control on the spread. They can offer even zero spread, because everything can be set at their side. Therefore, all the brokers who offer a fixed or zero spread are market makers. This is the first signal you have to notice. Spread cannot be fixed on the real currency market. Also, brokers that offer higher than usual spreads are market makers, because nowadays liquidity providers offer very low spread.

Markups and adding to the spread is fraud. Swap can also be fully controlled by market maker brokers. If a broker is offering a swap free account, it is a market maker broker forex market maker broker vs ecn broker. It is one of their sources of income that they cannot ignore, because they also have to pay it to the other dealer and organizations they are dealing with. Please note that although swap has a special formula that uses the same interest rate for calculations, different liquidity providers offer different swap, because they can control it.

I have never seen a real, well-known and strong liquidity provider like Bank of America, Nomura, Goldman Sachs, Deutsche Bank, Citi Bank, JP Morgan, Royal Bank, HSBC and… that supports micro-lots 0.

Another thing about leverage is that some brokers lower the leverage on weekends. They say they do it to protect the clients funds, whereas this is nonsense. They do it to make all the accounts that have negative positions, reach the stop out level and get wiped out. Those are the most important factors that you have to check with the brokers.

Hope I have not missed anything here. Please let me know if there is anything else that I have to explain. They allow you to scalp and you can do it if the markets allow you to. Therefore, forex market maker broker vs ecn broker, they make limits on taking profit and closing the positions.

When you see such limits, you should know that you are dealing with a market maker broker. Market maker brokers have limits on stop loss, target and trailing stop loss size. They cannot afford it, even if they make extra money through markups. Stay away from brokers who offer free bonus. And, they know that greed will make these trader to lose all.

It is only the trader who loses his capital. It is another trick by some market maker brokers. It is your account and you are the one who have lost money, because of the currency you have been trading. However, I have never seen that brokers prosecute retail traders for their negative balance, because if they say it in advance that it is the trader who has to pay for a negative balance, then no trader dares to sign up for an account, because not only you can lose your trading capital, but you have to pay extra for the negative balance.

They have to shut down the brokerage if they cannot do it, and they are the one who will be prosecuted by the liquidity providers. With the market maker brokers, a billion dollar negative balance on a live account is the same as a billion dollar loss on a demo account.

Do you pay any money to the broker when you blow up your demo account? Definitely not. You just sign up for another demo account. This is to deceive forex market maker broker vs ecn broker traders. They want the traders to feel safe. Then what happens if a strong movement occurs and your account goes to a negative balance? Read this article to receive the answer of these questions: The Swiss Franc Tsunami.

It is trading with the real world wide currency market. They charge a small fee for each transaction. That liquidity provider price is usually different from your platform price, for two reasons: 1 They are connected to different price resources. Although prices are usually so close to each other, still there is a difference. Under the normal market condition, this difference is not more than a few pips usually. Prices change all the time, forex market maker broker vs ecn broker, and so, the price can be different by the time the liquidity provider receives your order.

You have to send a request, and your requests have to be received, approved and executed. You cannot expect this to be done with your requested price. This is impossible. This entry price difference is still much better than the difference you will experience when trading through some market maker brokers. It is sometimes in your favor and sometimes against you, because it is based on the normal price differences, not intentional manipulations. It is almost the same with the exit price when you click on the close button.

Your exit price will be different from the price you see on the platform when you click on the close button. It is not always against you. Sometimes it is in your favor. However, market maker brokers who slip the price when you want to get in, also slip the price when you want to get out. This slippage is always against you.

When you set a stop loss and target order for a position, then, under the normal condition and in most cases the positions will be closed with the price which is too close to the stop loss or target order prices, forex market maker broker vs ecn broker, unless the market is too volatile because of the news release I will talk about this condition later. They have it at their own side, and when the price reaches the stop loss or target level, they send a closing request to the liquidity provider.

In this case, the close price difference can be larger compared to the case that the stop loss and target orders are placed forex market maker broker vs ecn broker the position that the liquidity provider is handling. The reason is the market volatility and the time that it takes to send the closing request to the liquidity provider, and the time the liquidity provider needs to receive and execute the request.

Like stop loss and target orders, some brokers place the pending orders with the liquidity providers, and some brokers hold the orders on their own servers, forex market maker broker vs ecn broker. When the price reaches the pending orders value, they send the request to the liquidity providers, forex market maker broker vs ecn broker. For the reasons I already explained above, with the first method, the entry price will be closer to the pending order value, but with the second method the difference will be larger.

Many market maker brokers slip the price when you want to enter the market through a pending order. Forex market maker broker vs ecn broker you complain, they will answer that it is impossible to enter the market exactly with the desired price in live and real trading, whereas this is a joke, because there is no real market when you trade through a market maker broker.

It is just the broker at the other side of the line. Sometimes when the price moves very fast and the market becomes too validate, and at the same time the liquidity providers get bombarded with too many orders, it becomes impossible to execute the stop loss and target orders.

It also becomes impossible to close the positions of the accounts that reach the margin call and stop out levels. The broker sends the request to the liquidity provider, but they cannot process it.

It is the same when the order is already placed with the liquidity provider. Therefore, some accounts that have no enough money to handle the negative positions, will have a negative balance when the liquidity provider succeeds to close the positions finally.

The broker will not receive any warning from the liquidity provider if it still has enough money in the account it has with the liquidity provider. However, sometimes even the broker account reaches the stop out level and even gets a negative balance. In both cases, the liquidity providers knows the broker as the responsible.

It is forex market maker broker vs ecn broker broker who has to pay the negative balance.

Broker Market Maker vs Broker STP/ECN

, time: 5:24ECN vs Market Maker Brokers

22/08/ · The market maker broker attracts more money, whereas it is the ECN/STP broker who is the real participant of the Forex market. ECN/STP brokers cannot offer any “negative balance protection”, because it doesn’t make sense to do blogger.comted Reading Time: 7 mins 19/11/ · For day trading, the ECN brokers are better because it is so much easier for the retail guys to manipulate prices in the short term. Also, most ECNs allow you to trade between the bid and the ask, so you can scalp as it was originally done by floor traders. Post. # 30/06/ · Differences between ECN and market maker brokers The primary difference between the two is that ECN supplies direct or 'straight through' access to the interbank market, while a market maker doesn't. At their core, currencies come from the interbank market, a group consisting primarily of large, recognized commercial banks like Citicorp, HSBC, JP Morgan, Deutsche Bank, etc

Geen opmerkings nie:

Plaas 'n opmerking