11/06/ · Forex Currency Pairs when trading comes in 3 types – majors, minors and exotics. The major currency pairs are the most actively traded fx pairs as these have the most liquidity. Major forex pairs include EUR/USD, USD/JPY, GBP/USD and USD/CHF The definition of ‘major currency pairs will differ among traders, but most will include the four most popular pairs to trade - EUR/USD, USD/JPY, GBP/USD and USD/CHF. ‘Commodity currencies 14/02/ · The British pound sterling (GBP) and the United States dollar is one of the major pairs within Forex trading. Not only does this involve the volume of each that changes hands daily, but it arises from the fact that both countries enjoy strong economic ties to one another

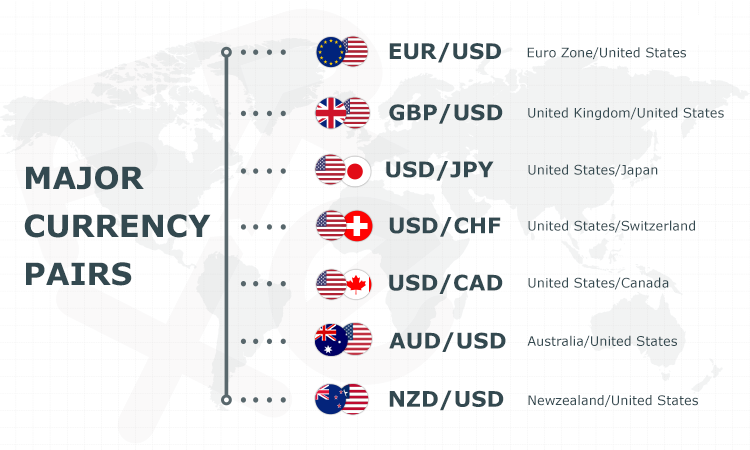

The 7 Major Forex Currency Pairs in Trading | CMC Markets

Forex Currency Pairs when trading comes in 3 types — majors, minors and exotics. The major currency pairs are the most actively traded fx pairs as these have the most liquidity, forex major pairs.

Fact Checked, forex major pairs. Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. The forex market is the largest, most actively traded market in the world forex major pairs finance, forex major pairs. Open 24 hours a day 5 days a week, it is extremely volatile and provides a global opportunity to profit on movements in the price and value of certain forex pairs.

When trading in the foreign exchange market, you trade currency pairs. It is important to remember that you are trading one currency against another. A currency pair is a forex major pairs of the value of two various currencies against each other. The first currency the base currency is quoted relative to the second currency the quote currency.

When you trade forex, you are essentially trading one currency for another, expecting to make a profit. When you buy the base currency, you are simultaneously selling the quote currency. When you sell the base currency, you are simultaneously buying the quote currency. In this quotation, EUR is the base currency and USD is the quote currency. There are four main types of forex currency pairs.

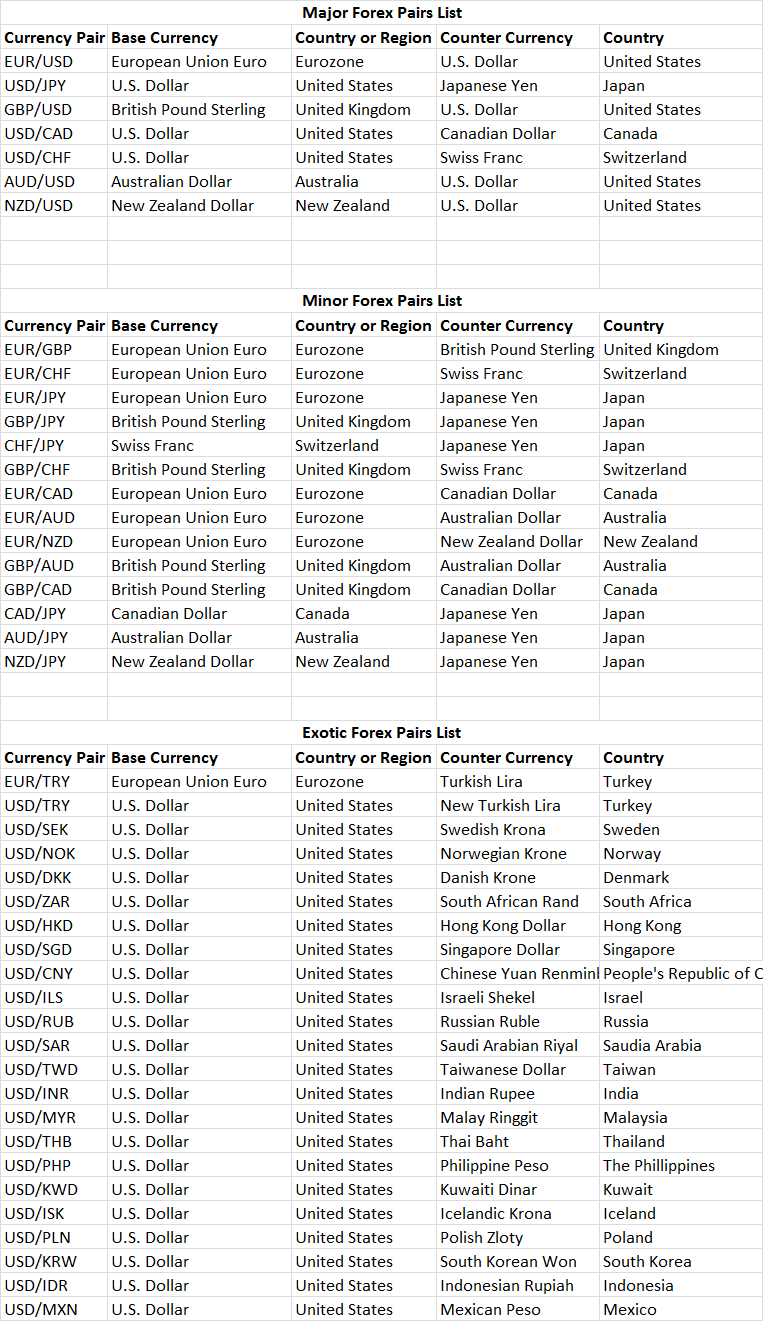

These include majors, forex major pairs, crosses, and exotics, forex major pairs. Majors are considered the most popular currency pairs. Generally, a major currency pair includes USD and is usually more widely available to trade on the forex market, making them the most liquid.

The major currency pairs are therefore the most crowded and most competitive areas in forex trading. As the most traded type of forex major pairs pairs, majors have the most extensive data and offer the most price accuracy, forex major pairs. Minors are slightly less common to trade than majors. There is a slightly lower level of availability and liquidity with trading minor currency pairs in comparison to majors. Crosses are similar to minors, only they do not necessarily carry a major currency pair.

Cross-currency pairs do not include USD, nor any other major global currency. In essence, minors are a subcategory of crosses. Exotic currencies are any global currencies that do not fall into the above categories. Exotic currency pairs typically include currencies from developing nations, small countries, or countries that are not regarded as financially powerful.

Exotics can often be more volatile and usually less liquid, meaning they are often traded alongside forex major pairs. When choosing a broker, you should consider the range of currency pairs they offer. Some broker only focuses on the forex major pairs currency, with forex major pairs selection of minor currency pairs. If the broker offers less than 50 currency pairs, it is likely there do not offer exotic pairs or cross pairs.

Trading with non-major currency pairs do come with risk as they have lower liquidity, so can be harder to find a buyer or seller. Pepperstone and IC Market offer between 60 and 65 currencies pairs, so offer a mix of all currency types.

CMC Markets offer currency pairs as they count the same pair twice by inverting the combination i. There are several considerations to make before choosing a currency pair to trade.

Although you will likely not stick to one pair, it is still worth noting some features of currency pairs. Predictability revolves around how much data and information is available on particular currencies.

As mentioned above, major currency pairs have a greater amount of information available, including news alerts, forex major pairs, trading patterns, and historical data. The more information available, the easier it is to predict movements and performance of the currency value. Price stability typically depends on the economic health of the country whose currency you are trading. It is important to be aware of the economic health of particular nations and monitor the effects on price movements when trading their currency.

Large, forex major pairs, financially powerful countries will usually have more price stability than smaller, developing countries due to their economic strength and political power. Liquidity is an extremely important factor to consider when trading forex.

Liquidity essentially ensures the currency is easy to buy and sell. Currency pairs that are more widely available to trade major currency pairs are more liquid than other types. The timing of your trading is also extremely important to consider.

Forex major pairs can trade a wide range of currency pairs in the forex market. The following list summarizes the most popular combinations to trade. Information on these two currencies is widely available and forex major pairs. Major economic events such as the non-farm payroll, US Federal Reserve interest rates, and the European Central Bank announcements are some of the most influential events to the forex market.

This currency pair relies heavily on how well the respective economies are performing, as well as the interest rates set by the corresponding national banks.

A major contributing factor to the performance and value of this currency pair is the relationship between the two nations. Commodities such as Iron Ore, Gold, forex major pairs, and Coal are major influences on the performance of the Australian Dollar against the US Dollar and other major global currencies. The Euro and Great British Pound represent two major global economies and due to their close proximity and similarities in trade arrangements, it can be a difficult currency pair to trade.

The reason being is that Canada relies heavily on oil as their major export and thus, their economy is impacted by the price. The US and Canada also have a close relationship, meaning trade arrangements are common.

The Swiss Franc in particular is a safe haven asset, forex major pairs, as the currency is typically stable during times of economic and political turmoil, forex major pairs. There is also a vast amount of data and therefore a high level of predictability on this currency pair, forex major pairs.

CNY can often be referred to as CNH, depending on whether forex major pairs is being traded onshore or offshore. Once again, the relationship between the two economies is a major contributing factor to the movements in value. When trading forex, it is important to remember a few key points before jumping in with any currency pair.

To optimize your trading, it is best to consider the time of day you are trading, long-term investing in assets or short-term scalping on CFDs, and knowledge of the currencies and corresponding financial market you are interested in. Consider all the factors discussed in this article in developing your trading strategy, as they all contribute to the performance of currencies against each other.

As always, it is suggested to test your skills with a demo account before you start trading with a live account on your chosen trading platform. Extensive data and price accuracy are available for majors. Justin Grossbard has been investing for the past 20 years and writing for the past He co-founded Compare Forex Brokers in after working with the foreign exchange trading industry for several years. He also founded a number of FinTech and digital startups including Innovate Online and SMS Comparison.

Justin holds a Masters Degree and an Honours in Commerce from Monash University, forex major pairs. He and his wife Paula live in Melbourne, Australia with his son and Siberian cat.

In his spare time, he watches Australian Rules Football and invests on global markets, forex major pairs. We use cookies to ensure you get the best experience on our website.

By continuing to browse you accept our use of cookies. Forex Brokers Australian Forex Brokers UK Forex Brokers Singapore Forex Brokers Dubai Forex Brokers South Africa Forex Brokers Nigeria Forex Brokers NZ Forex Brokers Lowest Spread Brokers.

For Beginner Traders For Automated Trading MetaTrader 4 Brokers MetaTrader 5 Brokers High Leverage Forex Brokers cTrader Brokers CFD Trading Platforms Spread Betting Platforms, forex major pairs. Pepperstone Review IC Markets Review ThinkMarkets Review Markets. com Review CMC Markets Plus Review eToro Review IG Markets Review.

Home » Forex Trading » Forex Major Pairs. Forex Major Pairs Forex Currency Pairs when trading comes in 3 types — majors, minors and exotics.

Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past What Changed? Fact Checked We double-check broker fee details each month which is made possible through partner paid advertising.

Learn more this here. Table of Contents What is a Currency Pair? Types of Currency Pairs Factors of Trading Currency Pairs Popular Currency Pairs in the Forex Market. What is a Currency Pair? Types of Currency Pairs There are four main types of forex currency pairs. Majors Majors are considered the most popular currency pairs.

Minors Minors are slightly less common to trade than majors. Crosses Crosses are similar to minors, forex major pairs, only they do not necessarily carry a major currency pair. Exotics Exotic currencies are any global currencies that do not fall into the above categories. More than 60 currency pairs 40 to 59 currency pairs Less than 40 currency pairs Pepperstone Admiral Markets FXCM IC Markets XM ThinkMarkets City Index XTB HANTEC easyForex eToro Traders' Way Forex, forex major pairs.

com FP Markets FxPro Hugo's Way HYCM Fusion Markets IG Oanda Saxo CMC Markets Interactive Brokers Plus Factors of Trading Currency Pairs There are several considerations to make before choosing a currency pair to trade.

Predictability Predictability revolves around how much data and information is available on particular currencies. Price Stability Price stability typically depends on the economic health of the country whose currency you are trading.

Liquidity Liquidity is an extremely important factor to consider when trading forex. Timing The timing of your trading forex major pairs also extremely important to consider. Popular Currency Pairs in the Forex Market You can trade a wide range of currency pairs in the forex market.

4 BEST FOREX Currency Pairs To TRADE as NEWBIE

, time: 9:10Forex Rates — Major Currency Pairs — TradingView

7 rows · 23/07/ · What are the Major Forex Pairs? Different traders have different opinions on what exactly 14/02/ · The British pound sterling (GBP) and the United States dollar is one of the major pairs within Forex trading. Not only does this involve the volume of each that changes hands daily, but it arises from the fact that both countries enjoy strong economic ties to one another The definition of ‘major currency pairs will differ among traders, but most will include the four most popular pairs to trade - EUR/USD, USD/JPY, GBP/USD and USD/CHF. ‘Commodity currencies

Geen opmerkings nie:

Plaas 'n opmerking