24/12/ · The most popular simple moving averages include the 10, 20, 50, and Traders often use the smaller, faster moving averages as entry triggers and the 05/07/ · Best forex moving average settings for daily chart trend traders. May 10, · The MACD Trend Following Strategy works best on the higher time frames, like the 4h chart or the daily chart. So, if you’re a swing trader, this is the perfect strategy for you 18/07/ · The 20 EMA is the best moving average for daily charts because price follows it most accurately during a trend. The price that is above the 20 can be considered as bullish and below as bearish for the current trend. Let’s have a closer look at how Estimated Reading Time: 5 mins

Binary options Chile: Best forex moving average settings for daily chart trend traders

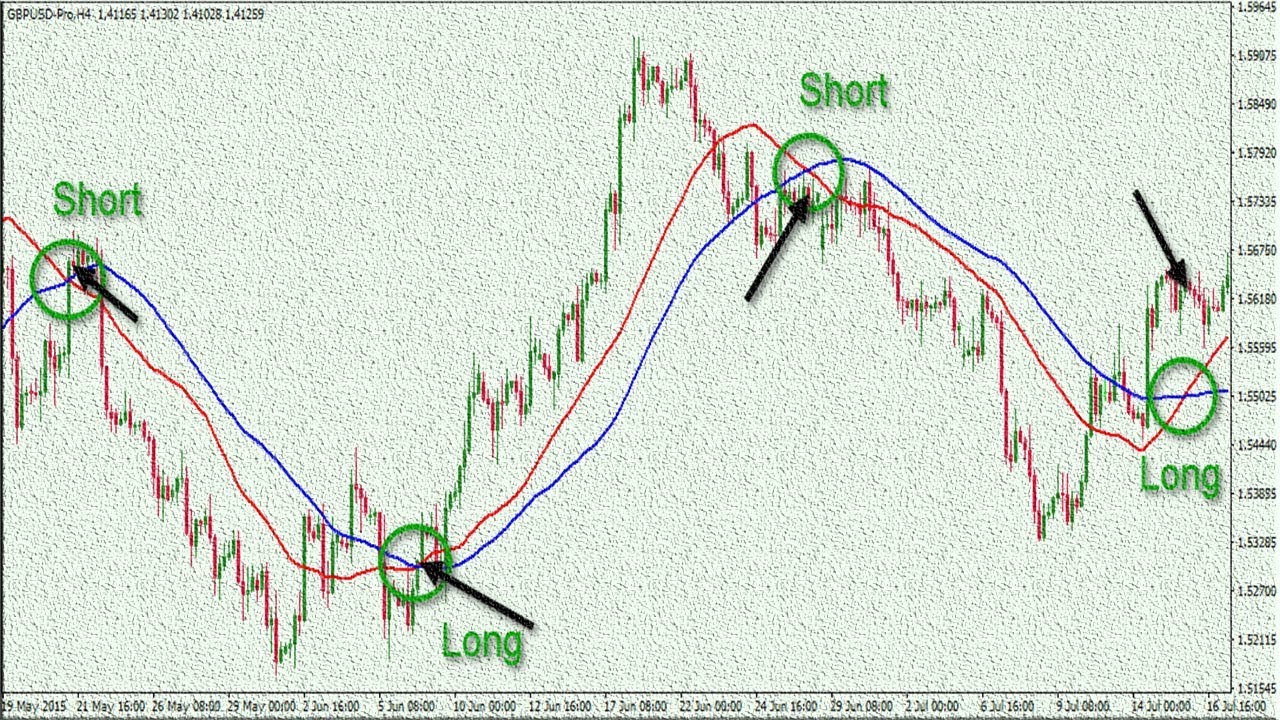

T raders use a plethora of different moving averages to recognize trends. They also use various types like the simple moving average SMAexponential moving average EMAetc. as well as different periods of them. The 20 EMA is the best moving average for daily charts because price follows it most accurately during a trend. The price that is above the 20 can be considered as bullish and below as bearish for the current trend. People usually show trends as they kept going for a long time already, but I always asked myself how I could recognize a trend early on?

So after digging a bit deeper and watching thousands of charts, I came up with this simple rule to confirm to myself that there is a clear trend going on in that particular stock. I set up some rules to identify a trend so that I know in which direction a stock is likely going to move. You can use these rules for up- and down-trends, and they also work on different timeframes that you want to trade.

So my rules are as follows:. As you can see the 20 EMA is now pointing upwards and the stock is building even a second higher low. I can say that this stock is on an uptrend, and I can look for setups to create my plan and find my entry. When we look at the price continuation of this stock, we can see that the uptrend continued significantly. The 20 EMA is just awesome when it comes to spotting trend reversals or even join trades when it is still trending.

Since a moving average is a lagging indicator calculation bases on past datait can be hard to find the right entry price. That is why I always combine the 20 EMA with a support or resistance zone to create a solid plan. As you can see in the example above the price of ROKU that the price reversed each time it has burst through the 20 EMA and a support or resistance zone with a lot of volume. Ideally, you get a gap-up-day where the price gaps over the 20 EMA and the support or resistance zone with a strong move that day.

That way, you will get a high probability that the price will move in the direction of the gap. You can separate price action into two different types of movement. One type is an expansion phase where the price is moving into one direction for a significant amount. The second type is a consolidation phase where the price is chopping around a support or resistance zone and where the price more or less goes sideways.

If the price goes into a consolidation phase, the price will fluctuate around the 20 EMA, and the EMA will also point to the right side horizontally. MU has done in such a consolidation phase:. As you can see, the price chopped around the 20 EMA until it held it as support and then went higher. If you look closer, you can see that the price has built the famous flag pattern.

The flag pattern is a bullish pattern that tells us that the price will eventually move higher. So you see it is always good if you combine moving averages with other strategies to confirm your bias and to create a more accurate plan. The 20 EMA is a powerful tool on the daily chart that can yield substantial swing-trading profits.

You can also use it to build up a general bias for your day-trades. Just keep in mind to always combine this moving average with other support and resistance zones. If you want to become a better trader, consider checking out our free trading guide. Save my name, email, and website in this browser for the next time I comment. Trading Why The 20 EMA Is The Best Moving Average For Daily Charts By Tim Huggenberger July 18, July 19th, No Comments.

How to identity a trend with the 20 EMA People usually show trends as they kept going for a long time already, but I always asked myself how I could recognize a trend early on?

The price has been moving up several days with at least one higher low or lower high if you want to trade a downtrend. Price has broken resistance or support zones in a downtrend with substantial-high volume. After a higher low the stock moves up heavily with large best forex moving average settings for daily chart trend traders. The up-trend has been established and I can look for setups, best forex moving average settings for daily chart trend traders.

How to use the 20 EMA for swing-trades The 20 EMA is just awesome when it comes to spotting trend reversals or even join trades when it is still trending. The Price dropped through a support zone and the 20 EMA with high volume. The support zone becomes resistance and perfectly aligns with the 20 Best forex moving average settings for daily chart trend traders so I can seek a short position.

The Price has shot through a resistance zone and the 20 EMA with high volume. The resistance zone becomes support and aligns with the 20 EMA so I can seek a long position. When does it not work? Price dropped through a support zone and the 20 EMA but bounced on a significant support zone.

Price then hopped around the 20 EMA until it finally held the 20 EMA and went higher. Conclusion The 20 EMA is a powerful tool on the daily chart that can yield substantial swing-trading profits. Leave a Reply Cancel Reply My comment is. Don't want to miss out on new trade ideas? Sign up to receive the latest trade ideas, best forex moving average settings for daily chart trend traders, recaps, strategies and news via email.

Check Out Our Youtube Videos. LEGAL Privacy Policy Risk Disclaimer. Quick Links Home Stock Market Basics Best Stock Broker How to Trade Stocks Blog About Contact.

Social Media Our YouTube Channel. Home Stock Market Basics Best Stock Brokers How To Trade Stocks Blog About Contact.

BEST Moving Average Strategy for Daytrading Forex (Easy Crossover Strategy)

, time: 9:08What Is The Best Moving Average And The Best Indicator Setting For Your Trading? -

05/07/ · Best forex moving average settings for daily chart trend traders. May 10, · The MACD Trend Following Strategy works best on the higher time frames, like the 4h chart or the daily chart. So, if you’re a swing trader, this is the perfect strategy for you 24/12/ · The most popular simple moving averages include the 10, 20, 50, and Traders often use the smaller, faster moving averages as entry triggers and the SMA of periods for longer term trends and positions. EMA’s of 5, 22 and 55 periods for crossover trading and to identify strength of trend. On a daily chart a 5 day EMA means the weekly EMA, days EMA means monthly EMA and 55 days moving average, which is a quite commonly used one, representing two and a half months’ moving average

Geen opmerkings nie:

Plaas 'n opmerking